The 6-Minute Rule for Offshore Banking

The European Union has actually presented sharing of details between certain territories, as well as imposed this in regard of particular regulated facilities, such as the UK Offshore Islands, to make sure that tax information is able to be shared in respect of interest (offshore banking). The Financial Institution Privacy Act calls for that Taxpayers file an FBAR for accounts outside of the United States that have balances over of $10,000 FATCA (the Foreign Account Tax Compliance Act) became law in 2010 and "targets tax non-compliance by United States taxpayers with international accounts [and also] concentrates on reporting by US taxpayers regarding specific foreign monetary accounts as well as offshore assets [and also] international economic organizations regarding financial accounts held by U.S

If you claimed the United States, the UK, the major G7 banks will not manage overseas bank centers that do not conform with G7 banks policies, these banks can not exist. They only exist because they involve in deals with common banks." This viewpoint did not age well following detractions at Goldman Sachs, Wells Fargo, Barclays, HSBC, and others.

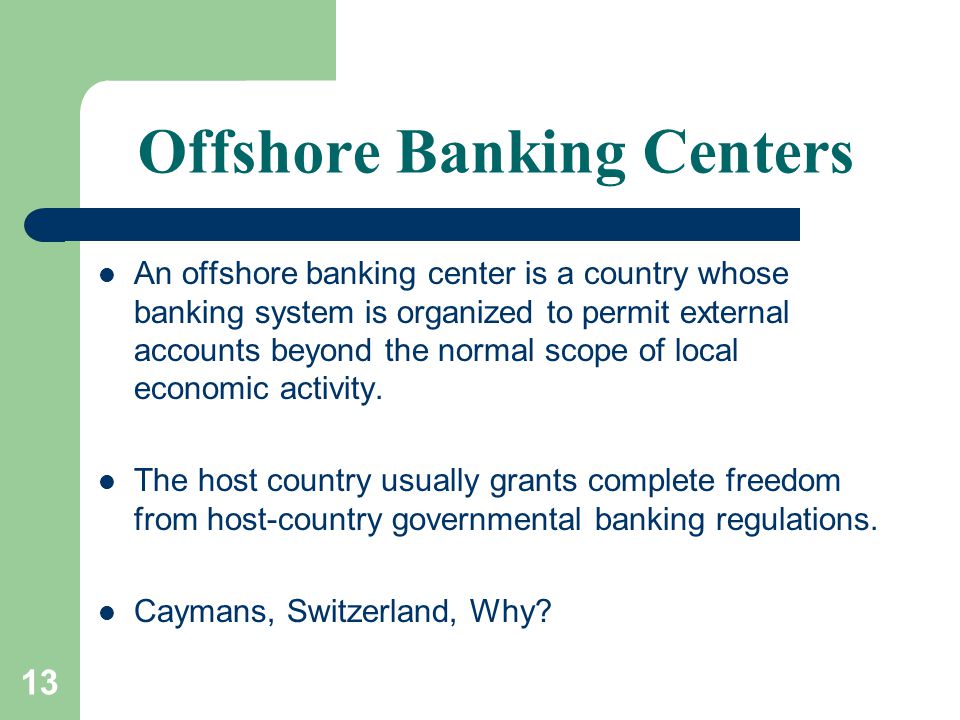

Offshore Financial Meaning? Offshore financial is merely a term utilized to describe the use of financial services in an international territory beyond the country where one lives. So any type of individual that has a checking account in an international country beyond their country of house is participating in overseas banking.

In the past, there were normally just a handful of jurisdictions in which banks provided offshore banking services, nonetheless, nowadays, one can open up an overseas checking account almost anywhere - offshore banking. That being said, there are still particular territories (such as Singapore, Belize, Cayman Islands and also Switzerland) that are extra distinguished for their usage as beneficial offshore atmospheres that have an ideal blend of financial benefits along with solid financial policies and practices.

All about Offshore Banking

Offshore Financial Institution Accounts, There are a couple of different methods which one can go around opening an global savings account, as well as various account types, which we will quickly check out: Personal Account vs. Corporate Account While it is possible to open a private overseas account in your own individual name, it is typically advised to integrate an offshore business in a foreign territory and consequently open a business account under the name of the business.

Corporate accounts are much easier to open whereas individual accounts can be much more hard. In theory, presumably much easier to open up an account in your own name contrasted to going via the extra actions of forming an offshore firm, however in fact, having a company entity be the owner of the account permits numerous benefits, Established financial institutions will typically have much more stringent needs for accepting a foreign person as opposed to a business.

A company account gives a lot better security as well as privacy. Opening an account in the name of an overseas firm divides as well as dis-identifies you personally from the account.

It is very valuable to look for the right professional assistance to help you with the procedure of creating a business offshore account in your chosen territory and structuring it in one of the most advantageous means. What We provide? Offshore Defense uses multi jurisdictional offshore strategies to restructure and also offshore your business and also possessions.

The 4-Minute Rule for Offshore Banking

Offshore Investment Account vs. Transactional Account, Besides picking a personal account or a business account with an overseas business, there are a couple of other significant account kinds, each with their own needs and uses. These various types of accounts can generally be separated as investment accounts and also transactional accounts. Investment accounts, They have a complicated framework, typically requiring the development of an offshore depend on and a reputable financial investment manager or broker.

They are suitable for high-value financiers that desire maximum returns and also security for their wide range and also do not plan on having numerous deals. offshore banking. Transactional accounts, They operate in a similar way to orthodox domestic transactional accounts. While they do not use the very same series of financial investment alternatives and premier services as big financial investment accounts, they serve for those who wish to have much easier accessibility to their funds, make normal transactions, and who are just seeking to start their overseas strategy with a tiny and also straightforward account.

We usually recommend the latter due to the added safety and security, security that an LLC brings. Remote Account Opening, Particular territories and also account kinds provide themselves even more to opening up an account from another location (e. g. Belize), as well as in specific circumstances, it may be much more functional to open an account remotely (if, for example, you are only opening a small account; it might not be monetarily sensible to take a trip right to the nation of option).

Variables that will establish the best area to open an offshore checking account would certainly be: What is your initial down payment? What type of account do you require? Where do you live and also what passport do you hold? What sort of financial services do you need? What is the purpose of the account? What are your tax commitments? The above information may assist you obtain a general suggestion of the kind of overseas account you are searching for, but also for an extra tailor-made offshore option, it is best to obtain a personalised method as each nation has refined distinctions that can make all the distinction.

The Main Principles Of Offshore Banking

One does not have to look really far throughout the world headings to see that corrupt regimes are still at big. Living in a risky setting, it is just sound judgment that a person would want to have a savings stored in a different area for safekeeping. Even in more 'autonomous' countries that may not be straight threatening there are still economic as well as economic uncertainties that a person would certainly want to be well gotten ready for.

click here now this contact form over here